Related documents

August 2024Group Licence list

Current exploration, development and production interests.

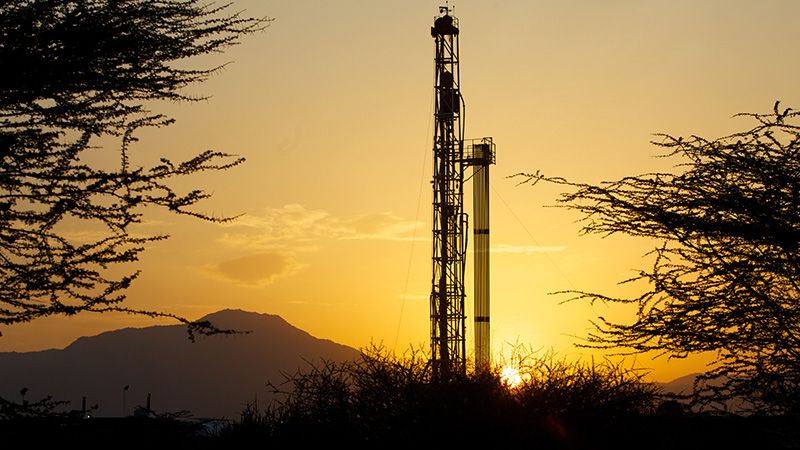

Download PDF 171KBUstawi - Tullow Kenya magazine

Local magazine showcasing Tullow's social investment projects and responsible operations in Turkana

Download PDF 4,846KB31 December 2015

Tullow Kenya BV 2015 Accounts

Download PDF 682KB31 December 2014

Tullow Kenya BV 2014 Accounts

Download PDF 1,190KBRelated links

Opportunity to realise value from discovered resources.

In 2020, the Early Oil Pilot Scheme (EOPS) successfully completed two years of production. Tullow and the Joint Venture Partners then closed down EOPS and demobilisation of all rental equipment was completed. The reservoir and production data gathered during EOPS was then used in the updated Field Development Plan (FDP), which intends to produce up to develop 470 mmboe of 2C resources to produce up to 120 kbopd.